The Consumer Financial Protection Bureau is suing America's three largest banks, accusing the institutions of failing to protect customers from fraud on Zelle, the payment platform they co-own.

According to the suit, which also targets Early Warning Services LLC, Zelle's official operator, Zelle users have lost more than $870 million over the network’s seven-year existence due to these alleged failures.

“The nation’s largest banks felt threatened by competing payment apps, so they rushed to put out Zelle,” said CFPB Director Rohit Chopra in a statement. “By their failing to put in place proper safeguards, Zelle became a gold mine for fraudsters, while often leaving victims to fend for themselves.”

Among the charges:

- Poor identity verification methods, which have allowed bad actors to quickly create accounts and target Zelle users.

- Allowing repeat offenders to continue to gain access to the platform

- Ignoring and failing to report instances of fraud

- Failing to properly investigate consumer complaints

The CFPB’s suit seeks to change the platform's operations, as well as obtain a civil money penalty, that would be paid into the CFPB’s victims relief fund.

A spokesperson for Zelle called the suit misguided and politically motivated.

“The CFPB’s attacks on Zelle are legally and factually flawed, and the timing of this lawsuit appears to be driven by political factors unrelated to Zelle," Jane Khodos, Zelle spokesperson, said in an emailed statement. "Zelle leads the fight against scams and fraud and has industry-leading reimbursement policies that go above and beyond the law."

In a follow-up statement, a Zelle spokesperson called the magnitude of CFPB's claims about customer losses due to fraud "misleading," adding that "many reported fraud claims are not found to involve actual fraud after investigation."

A JPMorgan spokesperson echoed those sentiments, calling it "a last ditch effort in pursuit of their political agenda."

"The CFPB is now overreaching its authority by making banks accountable for criminals, even including romance scammers," the bank said. "It’s a stunning demonstration of regulation by enforcement, skirting the required rulemaking process. Rather than going after criminals, the CFPB is jeopardizing the value and free nature of Zelle, a trusted payments service beloved by our customers."

A Bank of America spokesperson highlighted the importance of Zelle to everyday users.

"We strongly disagree with the CFPB’s effort to impose huge new costs on the 2,200 banks and credit unions that offer the free Zelle service to clients," said William Halldin in an emailed statement. "23 million Bank of America clients have embraced Zelle, regularly using it to send money to friends, family and people they trust."

Via email, a Wells Fargo spokesperson declined to comment.

Launched in 2017, Zelle allows users to send and receive money electronically. The platform has previously come in for criticism by Senate Democrats: Most recently, Sen. Richard Blumenthal, D-Connecticut, found customers had disputed over $372 million in scams and fraud in 2023 — with nearly three-quarters of the claimed losses never reimbursed by the banks.”

In its statement regarding the CFPB suit, Early Warning said reports of scams and fraud had decreased by nearly 50% in 2023, resulting in 99.95% of payments being sent without a report of scams and fraud.

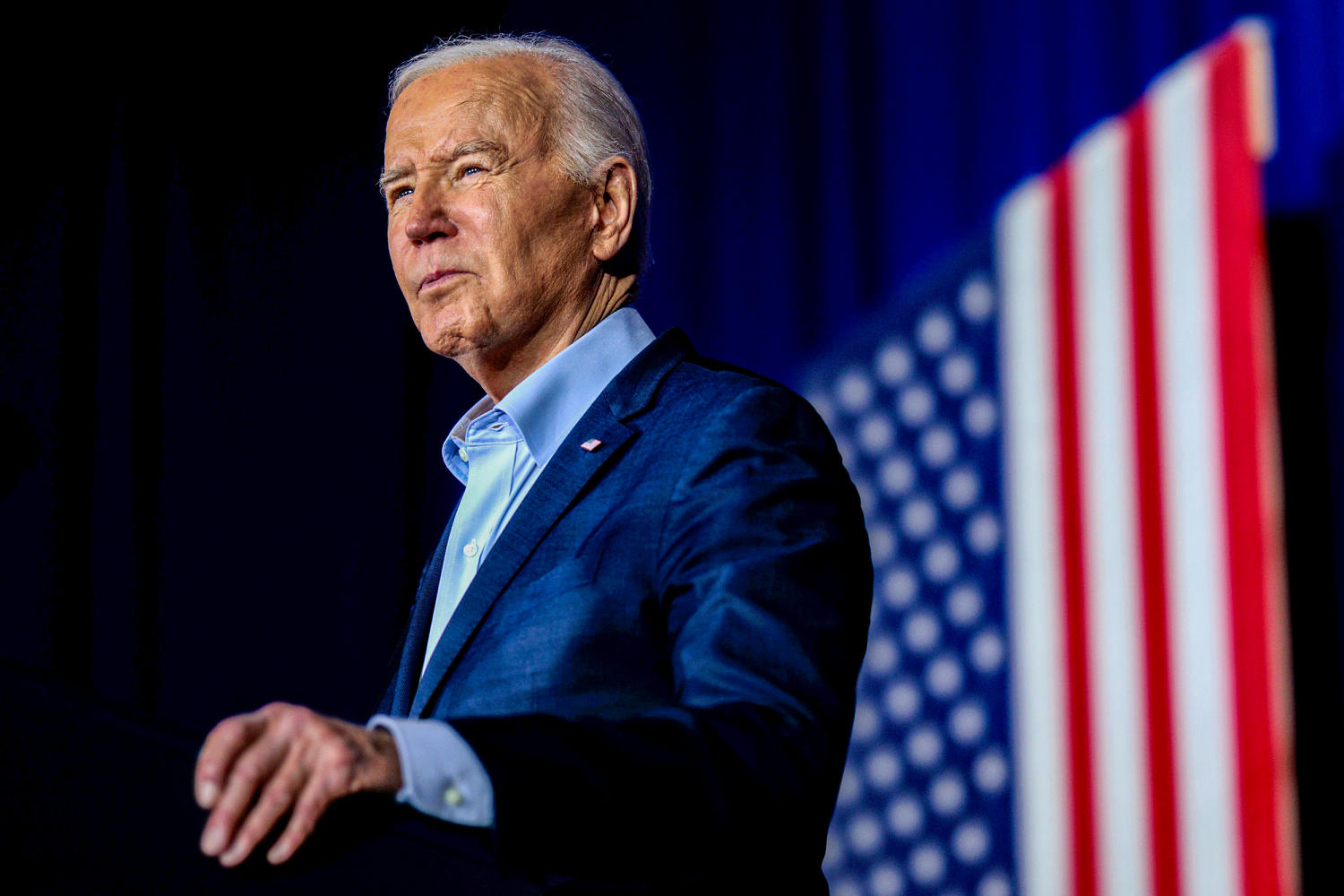

The CFPB has announced a number of measures this month designed to protect consumers amid threats to its continued existence from the incoming second Trump administration.

1 day ago

3

1 day ago

3

Bengali (BD) ·

Bengali (BD) ·  English (US) ·

English (US) ·